Today’s investors have an important decision to make when choosing a portfolio manager: do they want a manager who follows a Passive approach, investing fixed percentages primarily between stocks, bonds, and cash or an Active manager with the flexibility and latitude to adjust broad allocations between a wide range of asset classes as market and economic conditions change? We have the flexibility in our managed portfolios to seek investment opportunities across a broad spectrum of asset classes and strategies.

Strategy Selection

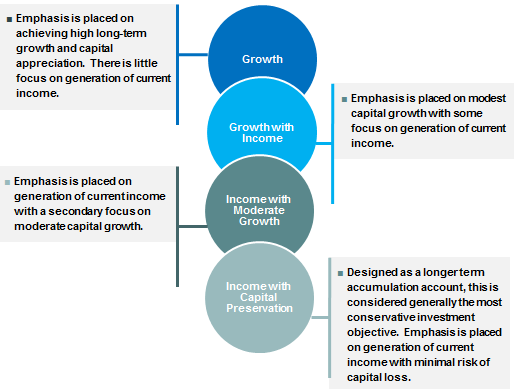

Our investment strategies offer investors a stand-alone strategy to fulfill a specific objective. All portfolios are actively managed utilizing the 4-Step investment management process outlined below:

4-Step Investment Management Process

Step 1: Determine the appropriate mix of stocks, bonds, and other asset classes for each portfolio based on current market conditions and our forward looking assessment of the investment landscape.

Step 2: Identify the most effective way to gain exposure to the asset classes we want to own.

Step 3: Utilize multiple analytical tools to help optimize our buy/sell decision-making process and to make tactical adjustments to portfolio asset classes.

Step 4: Continuously stress-test portfolios against both historical and forward-looking scenarios to assess the risks of major macro-economic or geopolitical events.

Custom Portfolio Management

We know costs and taxes can change everything—particularly for the high-net-worth investor. We can develop a highly personalized approach by combining internally managed strategies with rigorously selected third party managers. Customizing a portfolio generally involves customizing the tax management, the investment target, and incorporating outside constraints. We begin with a thorough understanding of your unique goals, risk tolerance, tax situation, return expectations and liquidity requirements. Then we carefully construct an investment plan created to help you work towards your objectives and manage your wealth according to your evolving circumstances.

Examples of customization

Personalized Tax Management-Your portfolio can be built around pre-existing securities allowing you to avoid selling positions unnecessarily. Additionally, capital losses can be harvested on an ongoing basis to help reduce your tax bill and invest more tax-efficiently. For individuals with large low cost basis positions, gain budgets can be established to allow for a multi-stage diversification process.

Personalized Security/Industry Exposure-Your portfolio can exclude specific securities or industries based on your needs. This is ideal for individuals who already have significant exposure to a particular stock/industry through various employer plans or would like to exclude certain investments for social reasons.

Asset Allocation does not ensure a profit or protect against a loss. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The information in this material is for information purposes only and is not intended to be specific advice. There is no "right" time to enter or exit a market. There is no guarantee that the investment objective will be met. More frequent buying and selling of assets may general higher transaction cost. Investors should consider the tax consequences of moving positions more frequently.

The investment objectives are overall objectives for the entire account and may be inconsistent with a particular holding at any time. Please note that achievement of the stated investment objectives is a long-term goal for the account.

Managed Accounts are only available on LPL Financial's Strategic Asset Management Platform.